Building Loan Contract

Why Bausparzentrale and how you can benefit?

What is building savings?

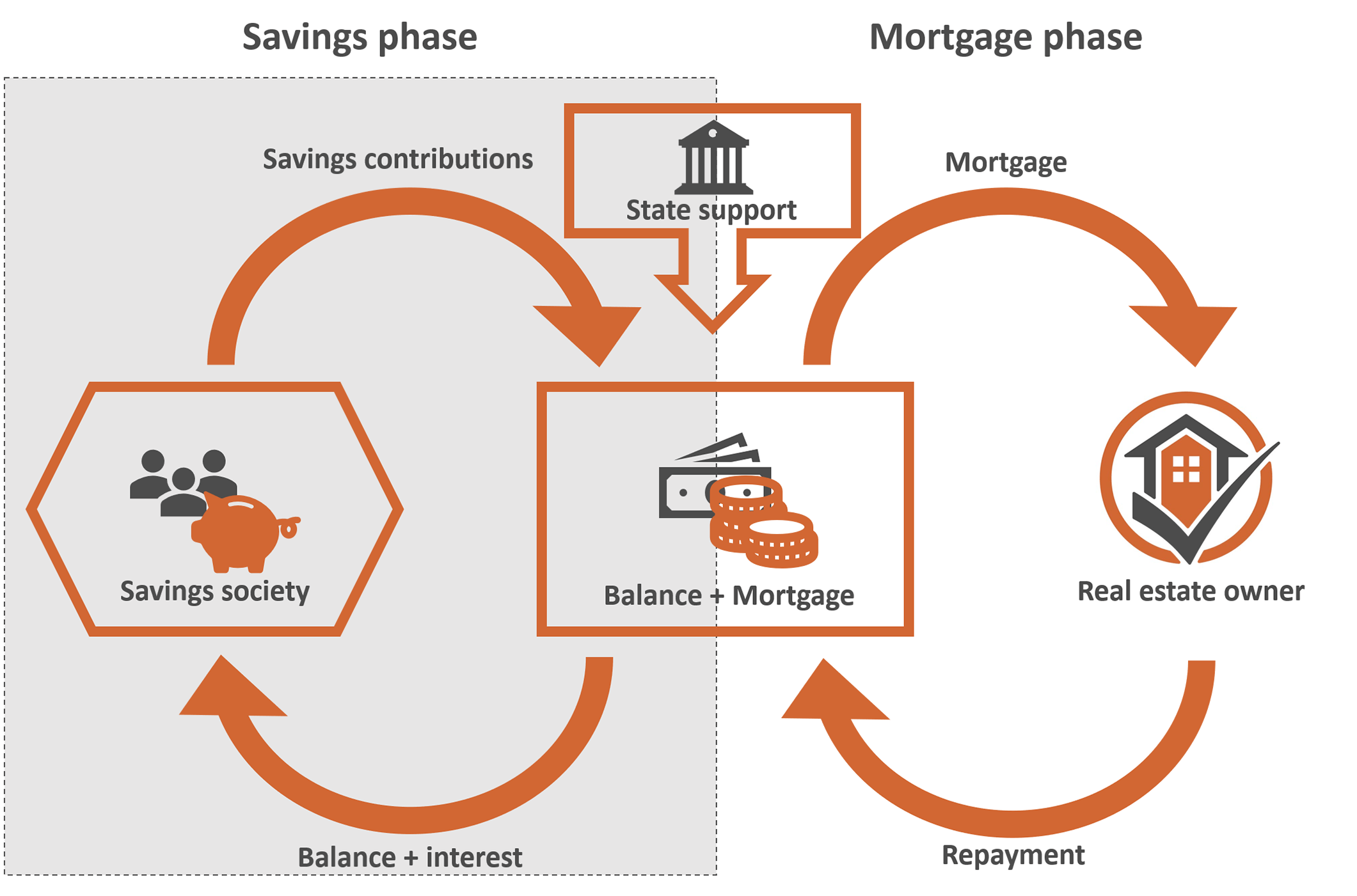

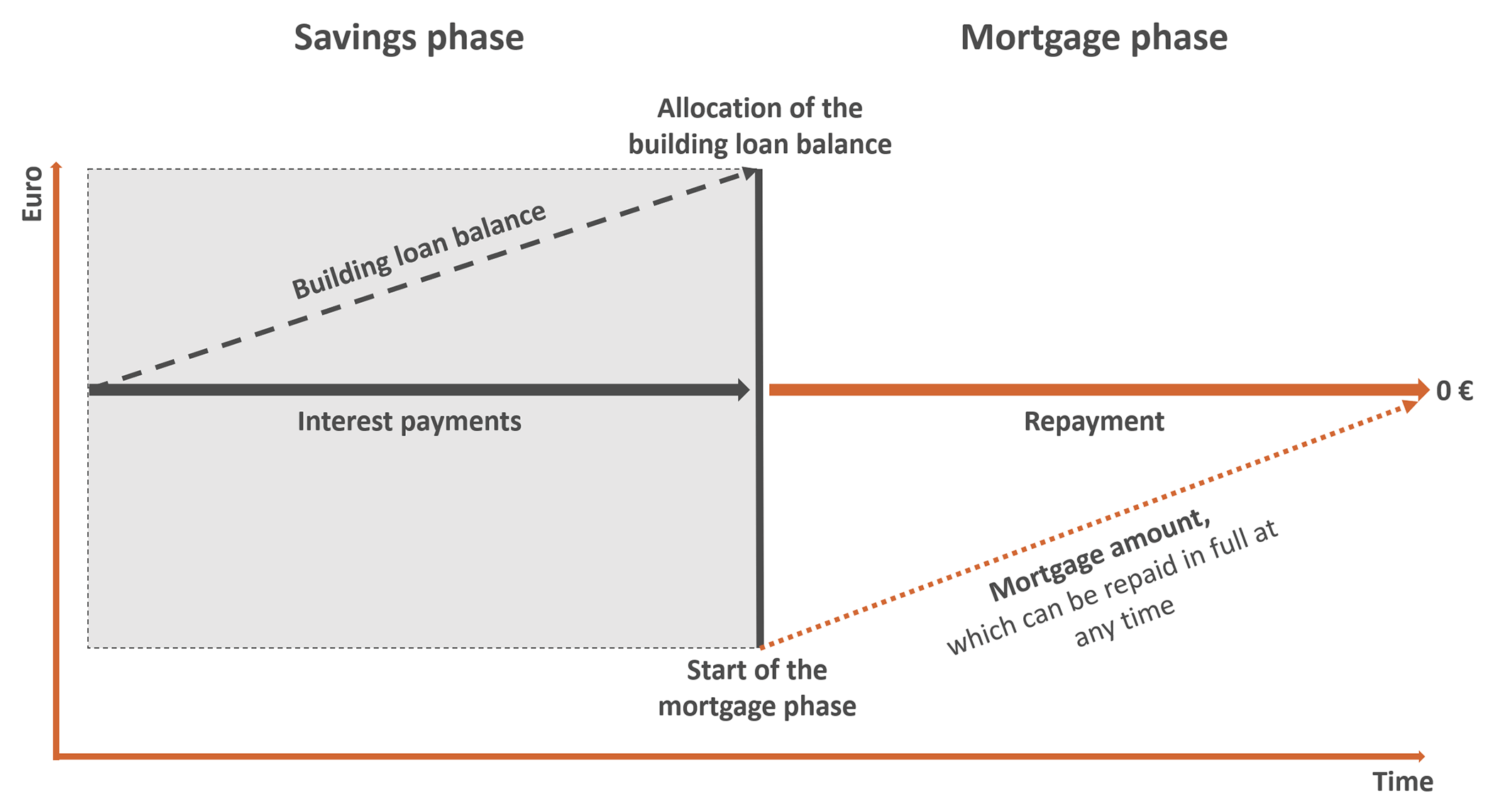

The following graphic is a simplification of the building savings contract:

How does building savings work?

Important points for building savings

In principle, building savings is suitable for people who have a interest rate security and planning certainty wish. This means that today interest for the entire term of the real estate loan. Thus you know exactly when and what amount paid will.

Building savings also serve as Hedging against rising interest rates. If interest rates rise in the future, you would still receive the conditions agreed in the building savings contract. As a rather conservative and safe product, the building savings contract may not achieve the highest return, however, it can serve to avoid high losses to be able to. With a building savings contract, you could protect yourself against rising interest rates and thus prevent your loan from becoming significantly more expensive than planned when follow-up financing is due. Particularly with the high prices for real estate in Germany, you should consider a building savings contract. Integrate a building savings contract into your real estate financing.

For many, the building savings contract helps not only to protect against financial risks, but also to avoid sleepless nights where you worry what will happen if you can't afford the payments on your property.

Building savings are suitable not only for people who want to build houses, but also for people who want to buy or modernise existing properties or carry out a conversion. Likewise, in some cases even interior furnishings can be paid for or other real estate loans can be redeemed. Thus, the building savings balance can versatile for residential purposes be used for the financing of cars. Therefore, building society loans are not suitable for financing cars. However, the money saved from the building savings contract can be paid out and a loan waived. Then the money is at your free disposal.

A building society loan is also suitable for persons who have a Flexibility during the loan phase. During the term of the building society loan you can unscheduled repayments in any amount afford. This is especially useful if you have a higher income in the future, with which you can and want the loan faster. Likewise, the unscheduled repayment should be considered if you would receive high payments, for example, from a sale of a property, inheritance or bonus payment. With classic real estate loans, the amount of unscheduled repayment is not available or only possible to a limited extent and therefore, in the case of unscheduled repayment would also incur an early repayment penalty.

Building savings can also make sense if you small sums which are often too low for classic real estate loans. There are many financial institutions that only grant real estate loans for sums over 50,000 euros. With a building savings contract, smaller sums are also possible. In this way, there is no need to take out instalment loans, which often entail a high interest rate. In addition, blank loans of up to 30,000 euros are often granted without a land charge being registered. This also helps with faster processing and thus the funds available faster. In addition, you also save the costs for the notary and the land registry costs.

Another advantage is that there is usually no interest premium if the creditor is registered in the second rank. This is a so-called subordinated loan. Many financial institutions often charge a significant interest surcharge or do not grant any real estate loans that are registered subordinate.

Building savings can also Discipline in saving promote. By taking out a building savings contract, you motivate yourself to save money regularly rather than spend it. This helps many people to make their dream of owning their own property possible.

Another important factor in building savings is the state subsidy. There are actually the following three options here:

- Employee savings allowance and capital-forming benefits, respectively

- Riester subsidy

- Housing subsidy

Under certain conditions, several options can even be used. Due to the state subsidies, building savings can also be worthwhile if you already own a property or if you live in rented accommodation and are not planning to buy a property. It is namely possible to use the subsidies for modernization and conversion for age-appropriate living. In the case of the employee savings allowance, it should be ensured in principle that the building savings amount is kept as low as possible so that the closing fees are not too high. We will be happy to discuss with you whether and which subsidy can be used.

Building savings can also be worthwhile for capital investors. One of the reasons for this is that with a home loan and savings contract you have a interest rate security over the entire term the loan. Thus, banks do not set imputed interest for the period after the debit interest rate lock expires. The challenge is that these imputed interest rates are usually much higher than the current interest rates and thus would put a lot more strain on your long-term budget bill. This can mean that your imputed budget bill becomes negative and therefore you may not be able to realise any further property finance.

If you want to buy and finance a property, you can do so with a combine building savings contract. One of the factors why this combination is popular is the safety factor. Because with the combination you secure a fixed interest rate over the entire term. This means that you will not be in for a nasty surprise when the fixed interest rate expires and the interest rate has to be renegotiated. Especially if you are afraid of the risk, you should consider this option. In addition, you do not have to wait until the building savings contract is ready for allocation until you can buy a property.

A home loan and savings contract not only gives you planning security and protection against interest rate increases, but also eases the burden on your long-term household accounts. The household bill is a critical factor in financing projects. As noted earlier, it is important to know that financial institutions apply imputed interest that could accrue on the loan after the borrowing rate lock has expired. These imputed interest rates are usually much higher than the current market rates. As a result, your imputed interest charge would be significantly higher, thus putting a strain on your household bill. Another advantage is that you can make unscheduled repayments of any amount during the loan period without having to pay an early repayment penalty.

Especially for Investor this is a very interesting option for several reasons. You do not redeem in the accumulation phase and save further capital, which you could use for further investments under certain circumstances.

How does the combination of classic real estate loan and building savings contract. At the beginning, the loan is paid out to purchase the property. Unlike a classic annuity loan, only the interest is paid to the financial institution. The amounts that could otherwise be used for repayment are paid into a building savings contract, where interest is paid and building savings credits are saved. When the building savings contract is ready for allocation, the amount is usually used to repay part of the loan amount. From this point on, you are in the loan phase and have a payment consisting of repayment and interest payment until the end of the repayment. Here, as already noted, it is possible at any time to pay unscheduled repayments in the desired amount and thereby shorten the loan phase.

Here are again the advantages for you at a glance:

- Interest rate security

- Planning security

- Hedging against rising interest rates

- Avoidance of possible losses

- Flexibility

- Unscheduled repayment in any amount

- Discipline in saving

- Equity capital for your property and thus better interest rates

- Versatile use for residential purposes

- State support

There are several ways in which the building savings contract could fit your needs. Do not hesitate to contact us to discuss your planning and ideas. We look forward to hearing from you. Feel free to contact us via our contact form.