Real Estate Financing

Why Bausparzentrale and how you can benefit?

Real Estate Financing

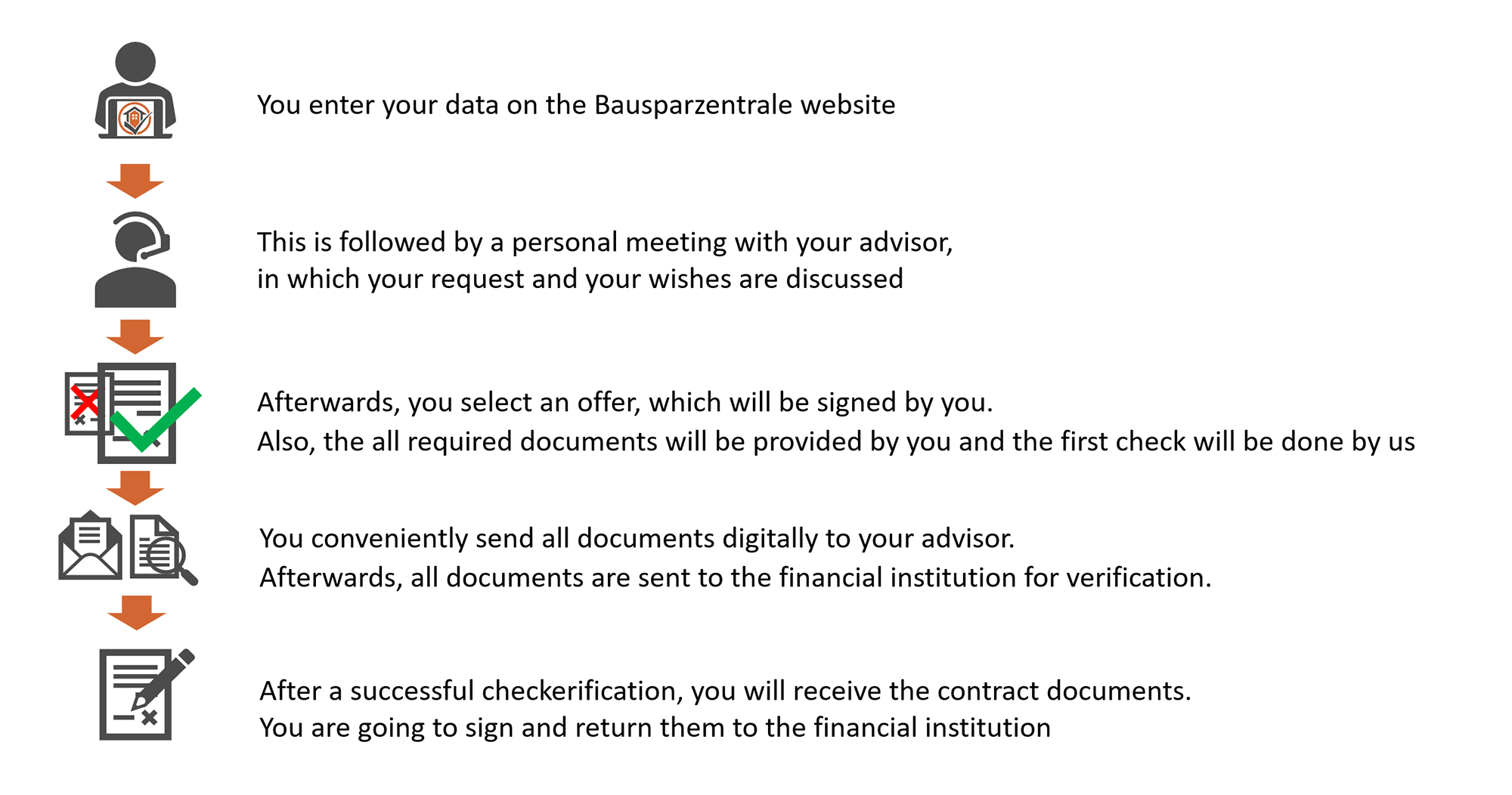

Here is the 5-step process

Wichtige Punkte für die Immobilienfinanzierung

As a rule of thumb, the net monthly income (consisting of, among other things, salary, rental income, regular other income such as variable compensation) x 100 is the amount you can afford as a loan amount. However, this is only a rule of thumb and in many cases the sum can be higher if, for example, other collaterals can be brought in such as real estate, building savings contracts, insurance policies, securities that can be pledged.

However, it is important to make a personal budget calculation in which you deduct all current costs (even those that do not occur every month, but e.g. only annually) from your income. You should also take extraordinary costs into account and maintain a risk buffer. Everything that is available to you after deducting the costs, you can use for the installment of your mortgage.

For variable or self-employment income, it is important to prove that it has been received regularly (over the last 3 years or more) or is contractually agreed. Payments for overtime or other bonuses can also be counted if the payments are regular and can be proven.

For 13th or even 14th month salaries as well as Christmas or vacation bonuses, proof must also be provided in many cases. If this is the case, many banks will also count this as income and it will have a positive impact on your credit rating.

The use of equity is the money you bring to purchase the property. Some banks require that at least the additional cost or services charges (e.g. notary, tax, real estate agent) regarding the purchase are covered by your own funds. Often it is required that the incidental purchase costs and 20% of the purchase price are paid from your own funds. However, there are many financial institutions that also accept less own funds. By using equity, you can also influence the interest rate. Basically, the more equity you bring in, the lower the interest rate. You can also bring in additional collateral to achieve this. For example, other real estate in Germany can be mortgaged and brought in as additional collateral. The important thing here is that the property is exempt or almost exempt from land charges. This is also possible with some securities as well as building society contracts, shares but also pension or life insurances. Note that the collateral cannot be sold and you should agree that the collateral will be released when the amount of the collateral has been repaid to the bank through the redemption.

However, you should not use all your equity (cash/money), as you should preserve liquidity in case you have unplanned expenses such as a new heating system, or expenses that are not related to the property such as buying a new car.

If you have less or no equity, then this can also be provided by third parties (such as parents). Consent and proof of the amount is required. Alternatively, you can cover this with a subordinated loan. Although the interest rates for such a subordinated loan as an equity substitute are higher, this can reduce the loan-to-value ratio and lower the interest rate for the real estate loan. This means that the overall interest burden can be lower, because interest surcharges are applied to the real estate loan if little or no equity is contributed. In addition, this also increases the probability of an approval for the real estate loan.

Many banks offer an special repayment option that allows you to pay off a portion of the loan earlier without having to pay an early repayment penalty. Typically, the amount is up to 5% per year of the original loan amount. A higher percentage can also be agreed sometimes. If, for example, you have received variable compensation and otherwise additional capital, you can use this to accelerate repayment. This is also an opportunity to preserve your liquidity, for example, by keeping the monthly installment moderate and using the special repayment as an additional option for the repayment.

The fixed interest rate period is the time for which you secure the conditions for the interest rate. Common in are Germany terms of 10, 15 or 20 years. The longer the fixed debit interest rate, the higher the interest rates usually are. Here you can say that risk and return go hand in hand, since you pay higher interest for a longer planning security. You can also agree on a full repayment. In this case, an interest rate is agreed for the entire term. In general, the fixed interest rate period should fit your planning and your risk tolerance. For example, if you expect a large payment in 5 years with which you want to repay the loan, then you should agree on the period accordingly. This will prevent you from having to pay an early repayment penalty. After expiration of the fixed debit interest rate, an ongoing financing must take place with a new interest rate or be repaid in full. With ongoing financing, you do not have to renew with the current bank and you could do it with another bank. A comparison can therefore be worthwhile if you need ongoing financing.

However, there are also many other important factors that are relevant here. These are, for example, whether you are fully financing the property or only contributing very little equity and whether you want to purchase more properties in Germany in the future.

Important: The fixed interest rate period should not be confused with the term until the property is paid off. After expiry of the fixed interest rate period, ongoing financing is often required for the outstanding amount.

A combination with a building loan contract is also possible. The advantages here are that you enjoy interest rate security over the entire term and do not have to renegotiate after expiration of the fixed interest rate period. This is a variant for people who want planning security. You usually also have the option of making unscheduled repayments of any amount once the mortgage for the building loan contract has been paid out. This, for example, can be particularly attractive if your income is so high in the future that you would like to repay the financing more quickly than it is possible today. This option can be interesting for capital investors or those who wish to purchase several properties. We would be happy to explain this model to you in a personal conversation.

This indicates how much of the loan amount is repaid per year. Some banks offer you better interest rates if a certain repayment is set. Also, some banks offer the option to adjust the repayment. This can be important if you want to repay more in the future or repay less, for example, if you go on parental leave and for a certain time your income is reduced. In this way, you can reduce the monthly burden on your budget.

Therefore, you should take into account your plans for the future when you agree on the repayment.

Also, you should consider whether the option is important to you that the repayment rate can be changed. Note that this is not possible with every lender and is limited with some lenders and may be subject to a fee.

Also in real estate loans, there are different variants. The most common variant is an annuity loan, where part of the installment is used for interest payments and the other part for repayment of the loan. A full tiger loan is also like an annuity loan, but the entire loan is repaid over the agreed fixed interest period.

Another variant is the interest payment loan. In this variant, only interest is paid initially and the loan is repaid at a certain point in time. This variant is classically combined with a building savings contract.

Interim financing, also called pre-financing, is often used to bridge the gap if, for example, your equity is not available at the moment or you are buying another property and cannot yet sell your current property. The term is usually no longer than 24 months.

In the case of a construction project, you should also take into account when your property will be completed or when the last installment will be made, so that you avoid commitment interest. After the expiry of the commitment interest-free period (usually three to twelve months), you will be charged additional interest (usually 0.25% per month, i.e. 3% per year) on the sum that has not yet been disbursed. For example, if you take out a loan of 300,000 euros and 100,000 euros are still to be disbursed after the end of the availability interest-free period, then you will pay 250 euros per month in interest, which is usually added to the loan amount. This is effectively a fee for the bank reserving the money for you and not using it for other business.

However, you should consider whether an offer with a shorter interest-free period will still be more favorable over the term or in the long term, if the interest rates are lower.

Note: Think carefully about the above points, so that you get the loan that fits your needs and life planning. We will be happy to advise you on your plans.

There are various factors that make real estate financing more challenging. The following factors will give you a good overview:

Fixed-term employment contracts and probationary period

People who are still in the probationary period or are on a fixed-term employment contract are also not accompanied by all financial institutions. Here it is important to explain why the employment contract is fixed-term and whether this is common in the industry.

If you are on parental leave, it is important to explain when the parental leave ends and under what conditions as well as when you will return to work.

Self-employed and freelance activities

For self-employed persons or freelancers, it is important that you have already been working for 36 months or 3 full financial years or longer. In this case, much more information is often required than from applicants in an employed relationship. Some banks also classify you as self-employed if you hold a shareholding of more than 50% or in some cases even 25% or less, even if you are employed as a managing director or on the board of directors.

Foreign employment contracts

If you have concluded an employment contract outside Germany, it should be explained why this is the case. It is also important that your salary is in Euros, so there is no currency risk.

Number of borrowers

Many financial institutions want the loan to be taken out by a maximum of two or four borrowers. If you want to apply for a loan in a larger group, then this must be requested in advance.

Age of the borrowers

The age of the borrower also plays a role, especially with regard to the amount of repayment and the amount of equity. Here can be said in principle: The higher the age, the higher the repayment rate and the equity.

Nationality and residence

In terms of nationality, it is important for real estate financing in Germany that the borrower is an EU citizen or, alternatively, has a permanent residence permit. If this is not the case, then there are few financial institutions that will approve a request. However, there is the possibility of financing under certain conditions. It is also important for many banks that German language skills are available and that the residence is in Germany or in the EU. However, it is often accepted if a translator is used.

Taxable in Germany

For many banks it is important that the person applying for a loan is taxable in Germany. If you are not taxable in Germany, then this must usually be explained to the financial institution. For example, if you work for international organization, then a confirmation from your employer is required to show why no taxes are paid.

Construction method

For some special construction methods, such as a wooden building or prefabricated house, some financial institutions require proof of the lifespan.

Leasehold

As a rule, it can be said that paying for a property with a leasehold is not recommended. Ask yourself why you want to buy a property with a leasehold. Often the initial purchase price is relatively low, but that is in many cases already the only advantage. The disadvantages usually outweigh the advantages.

Here are some of the disadvantages:

- The ground rent may increase

- You will never own the property, but you pay taxes, the ground rent, etc. and cannot inherit it

- The property may not be changed at will

- Uncertainty because of the limited term

- The selling price may decrease sharply as the term of the leasehold nears its end

Additionally, financing is complicated because in most cases you must bring a lot of equity and repayment must be made at least 10 years before the end of the leasehold term. Without a standstill declaration, most banks are also not willing to approve financing.

Multi-family houses

If a multi-family houses (usually a property with three or more apartments) is to be financed, then the income approach or purchase price factor is usually used to evaluate a financing request. With the purchase price factor, the purchase price is placed in relation to the initial annual net cold rent. This can also be used generally for real estate purchases as an investment. The following is an example: 250,000 euros purchase price / 7,800 euros = around 32. The lower the factor (32 in this case), the better the rental income in relation to the purchase price. However, you should also consider the condition of the apartment and other variables.

Often, the buyer is required to have a large amount of equity in relation to the purchase price. This is often not possible for many prospective buyers, because with the high purchase prices the additional costs are already quite high. Here, too, we have special solutions where it may even be possible to finance the additional costs as well.

Prior charges

Prior charges that reduce the value of the property, especially those that have priority. One of the most common cases is the right of usufruct, heritable building rights or priority claims from other lenders. This increases the risk to the lender, in the event of default increases the likelihood of loss. Therefore, financing real estate with prior encumbrances is often complicated or impossible.

Through the KfW you have the opportunity to receive assistance with financing your real estate purchase. There are various support programs for, for example, self-use, energy-efficient construction or modernization. Often, the KfW loan is considered by financial institutions as a kind of equity and this can improve the interest rate. Also, the interest rate of the KfW loan can be lower than the market interest rate and you save on interest as a result. Important current information can be found here: https://www.kfw.de/inlandsfoerderung/Privatpersonen/index-2.html

Likewise, many federal states also provide low-interest loans through development banks. Here it must be examined whether the promotion programs fit to your projects. You should also check how the subsidies can be optimally used for your project.

Financing real estate abroad is more challenging than in Germany. One of the most common ways is to mortgage a property in Germany. This means that if you own a property in Germany that is (almost) paid off or free of land charges, it can be mortgaged. You can then use the money to purchase a property abroad. You can also take out an installment loan to purchase a property abroad. Here, however, the amount is very limited and the interest rate is usually higher than for real estate loans.

For most borrowers, this is the part of the financing that is the most elaborate. Basically required documents are such as:

- Proof of income

- Income tax statement

- Copy of the passport

- Extract from the land register

- Declaration of division

- Calculation of living space

- Cadastral map

- Floor plan

Each bank has different requirements for the documents that need to be provided. This can be very time consuming and frustrating at times, as many documents still need to be organized.

At this point we tell you, hang in there and feel free to ask us if you need help.

As you can see, real estate financing is complex and many factors play an important role. Therefore, a personal consultation and the comparison of offers are highly recommended. We want to accompany you and support you in your planning, so that you get the mortgage that fits your needs. As a partner on your side, we will be at your side with personal advice throughout the entire term, for example, if you need help with unscheduled repayment or your ongoing financing is pending. We look forward to hearing from you. Start your inquiry now or use the contact form in order to start discussing your plans.